Canada’s Budget 2022 Includes Higher Disbursement Quota

May 9, 2022 | Blog

Canada’s 2022 budget implements proposals that affect certain assets held by charitable funders, including family foundations. One of these proposals increases the disbursement quota (DQ) for a charitable foundation’s assets. Though few details are out, we want to share what we know so far as to how this affects family foundations.

Here’s the change: Effective January 1, 2023, a charitable foundation’s investment assets over $1 million will be subject to a 5% DQ. Investment assets below $1 million will remain subject to the current 3.5%.

The justification for this increase is that it promotes charitable spending as Canadians recover from the pandemic. Imagine Canada, Canada Gives and the Philanthropic Foundations Canada are among the many organizations that support the increase. The rate is comparable to distribution requirements in the United States and Australia.

Why a DQ increase is good

First, a definition

The disbursement quota is the minimum calculated amount that a registered charity must spend in a year on doing what it was created to do.

- Make grants or

- Otherwise further its charitable purposes.

The DQ rate is based on the 24-month average fair market value of property that is not used for charitable activities or administration. This is usually investments and real estate.

The intent of the DQ ensures that funders, such as family foundations, move their money into the charitable sector, for charitable purposes more expediently. The intent of an increased DQ is to raise the amount of funds disbursed to charities.

Starting March 2020, COVID-19 hit charities and foundations hard. According to Susan Phillips at Carleton University, nearly 70% of Canada’s charities saw their revenues decline by almost a third during the pandemic. This significantly impaired their ability to provide vital services to Canadians during a critical time. While many smaller foundations struggled to keep up with a suddenly increased demand for services, other larger foundations could not keep pace with their investment asset growth.

Knowing this, the government began a study in 2021 on whether the DQ needed to be changed. The change focuses on how to make more charitable funds available. The study included soliciting feedback from the charitable sector on whether the current rate (3.5%) was effectively balancing sustainable funding with charitable spending, said the Financial Post.

The feedback reflected an overwhelming desire to see the DQ go up. According to Imagine Canada:

“The unabated increase in demand for services from charities and nonprofit organizations since the start of the pandemic combined with the nonprofit sector’s determined advocacy have elevated the need for action to ensure that Canadians have access to these vital services.”

Future of Good said an increase would “boost support for the charitable sector, ” freeing up $700 million in assets for nonprofits and charities, “at a level that is sustainable, ensuring the continued availability of funding over the longer term.”

Like Imagine Canada, Philanthropic Foundations Canada (PFC) asked for an increase as part of their advocacy efforts, especially to get more charitable dollars to groups seeking social justice and equity.

As mentioned, the new 5% requirement is effective with a charity’s fiscal year beginning on or after January 1, 2023. Charities that don’t meet the new threshold in 2023 must exceed it in 2024 so that the average of those two years is at least 5%. Alternatives still include:

a) applying your charity’s available carryover from the last five years, and

b) applying to the Canada Revenue Agency for relief.

The government will review the DQ percentage every five years.

Does an increased DQ go far enough?

Many within the charitable sector say a DQ increase may not accomplish its intent.

First, the effort will be for nothing unless the CRA can better determine whether funders like family foundations are meeting their DQ. Charities that are not complying with the current quota requirements aren’t apt to comply with a higher one.

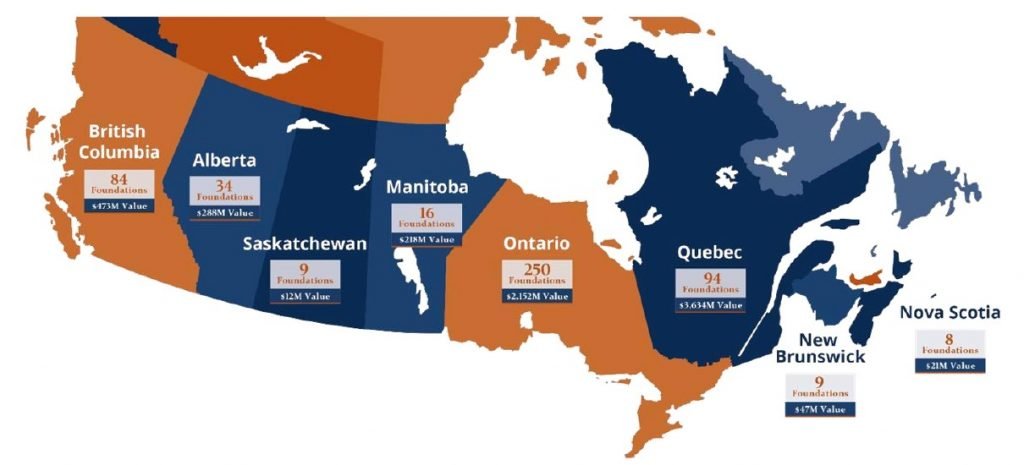

And Canada does have foundations that don’t meet their DQ. A May 2020 report by Karma & Cents, “State of Dormant Family Foundations in Canada,” found that about $40B was sitting in private family foundations in 2015. While these same foundations moved just $5.6B into the charitable sector. Charities lawyer Mark Blumberg, estimates that 23% of private foundations moved 4% or less into the charitable sector for five consecutive years. That’s more than $1B in assets having very limited philanthropic impact. In April 2022, Canada Gives said 67% of the top private foundations are not meeting their disbursement obligations.

Second, a 5% annual DQ may not be realistic given the requirements of the CRA and the Trustee Act on how funds can be managed. Note – Each province has a different Trustee Act. The one referenced in this article is from Ontario.

Third, one of the most consistent arguments against the Budget 2022 DQ-related proposals is that it won’t benefit the groups that need charitable help the most: those assisting the underserved. An example of this under-served population are members of the BIPOC community. Unfortunately, many charities that serve these populations don’t have the marketing budgets that large organizations do to attract large donors. An increased DQ isn’t likely to grab their attention, either—so those charities likely won’t benefit much from this opportunity.

Budget 2022 does address some criticisms with provisions to streamline and improve the accuracy of DQ calculation and collection. These provisions include:

- amending the Income Tax Act to clarify the expenditures that can be counted as “administration and management” and thus excluded from charity’s DQ calculation,

- permitting the Canada Revenue Agency to reduce a charity’s DQ percentage for a tax year,

- removing the accumulation of property rule, which exempts charities from including certain property in their DQ calculations, and

- improving the Canada Revenue Agency’s ability to collect “information related to investments and donor-advised funds” and other information applicable to the DQ.

What do you need to do right now?

No legislation or specific guidelines for any of these changes has been created. When it is, look to this space for guidance.

QUICK FACTS

- Disbursement quota (DQ) increasing to 5% for investment assets >$1M

- Assets <$1M still at 3.5% DQ

- Effective January 1, 2023

- Can average 2023 and 2024

- Exemptions are still available